The Goldleaf advantage.

Highly Skilled

Management Team

Goldleaf is led by a highly skilled management team with decades of combined experience in real estate finance, fix-and-flip investing, ground up construction, and debt lending.

Best Lender

Partners

Goldleaf provides real estate “fix and flip” investors with equity gap financing and the best debt financing through its lender-partners.

Structured Equity

Partner

Goldleaf is a structured equity partner and shares in the proceeds of the sale of the project, using this first to market

solution.

One-Stop

Financing Solution

Goldleaf is a one-stop financing solution for real estate “flippers,” providing best-in-class financing solutions to pursue the most lucrative real estate opportunities.

Meticulous

Underwriting

Goldleaf protects investments through the meticulous underwriting of the 1st position lenders and the joint participation of the borrowers.

Secured Liquidity

For Equity

Goldleaf provides secured, short term (~1 year) liquidity to qualified borrowers in exchange for equity in the project.

Goldleaf is committed to its clients by providing them with the best capital solutions to pursue lucrative opportunities in the single-family real

estate fix & flip market.

What we do

Goldleaf provides a first-to-market equity gap financing solution for single-family home fix-and-flip investors, enhancing liquidity and maximizing returns. By providing up to 50% of the required equity for projects, Goldleaf enables investors to close deals they might otherwise be unable to finance or preserve capital for additional opportunities.

Goldleaf also markets direct to investors by educating fix-and-flippers at events and online marketing programs.

In addition to equity gap financing, we facilitate competitive debt financing through strategic lender referral agreements. These referrals target fix-and-flip investors who either lack the necessary liquidity or prefer to retain capital for other ventures.

More than 75 years experience

We work with ambitious leaders who built Goldleaf to fill a unique niche in the residential real estate industry, leveraging competitive partnerships with direct lenders to deliver flexible and effective funding options.

0

0

0

0

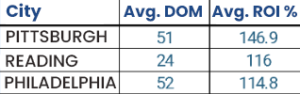

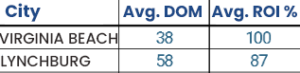

Top single family homes

fix and flip markets

Goldleaf provides a first-to-market equity gap financing solution for single-family home fix-and-flip investors, enhancing liquidity and maximizing returns. By providing up to 50% of the required equity for projects, Goldleaf enables investors to close deals they might otherwise be unable to finance or preserve capital for additional opportunities.

Pennsylvania

Florida

Tennessee

Virginia

New York

Georgia

![]()

Maryland

![]()

Ohio

![]()

New Jersey

![]()

Oklahoma

As a seasoned real estate investor, I see Goldleaf as a go-to resource for myself, but also for thousands of motivated investors across the country. I now have the additional flexibility to secure projects as lucrative opportunities become available.

Doug Bowes

,

I am a residential developer and am extremely excited about working with Goldleaf not only as a strategic capital source, but as a trusted partner.

Rick Johnston

,

I’ve done thousands of real estate deals, and I can confidently say Goldleaf is poised to take off like a rocket. Their timing is impeccable, their team is top-tier, and they’re solving the biggest barrier in the game: access to capital. In a market where the average home price keeps climbing, Goldleaf is the launchpad investors have been waiting for.

Eugene Schroeder

,

Fix & flip problems

Goldleaf solutions

Goldleaf Investment Fund offers more than just financial support; we’re your partner in growth. With solutions designed to reduce upfront costs and boost profitability, we give you the tools you need to scale faster and achieve greater success in the competitive real estate market.

|

PROBLEM

|

SOLUTION

|

|---|---|

|

Lack of liquidity to close on investment properties. |

Goldleaf provides 50% of the liquidity requirements for loan closings. |

|

Flippers lack a position of strength to negotiate best debt rates with lenders. |

Goldleaf leverages its lender relationships to provide the best debt financing options. |

|

Limitations of deal volume due to liquidity constraints. |

Goldleaf enables flippers to scale their deal volume by providing access to additional liquidity. |

|

Lower ROIs due to large deposit requirements. |

Goldleaf reduces liquidity requirements ensuring higher ROIs |

Our expertise

our leadership

Our team is made up of a diverse group of industry professionals, each bringing a wealth of experience and expertise to the table. This includes seasoned real estate investors with a track record of successful ventures, savvy entrepreneurs who know how to spot and seize opportunities, and finance experts with a deep understanding of managing investments and maximizing returns. Together, we combine our skills and knowledge to provide comprehensive insights, innovative strategies, and valuable guidance, ensuring that your real estate goals are always within reach.

-

Jason Levine

Legal AdvisorJason Levine is an accomplished entrepreneurial executive and licensed attorney with an MBA/JD from...

view profile -

Eugene Schroeder

Director of FeasibilityEugene Schroeder, with over 20 years in real estate, began buying and selling Florida properties...

view profile -

Carla Miaule

Director of Investor RelationsCarla has over 25 years of business and real estate investment experience and has an Executive MBA...

view profile -

Andy Carlton

Director of UnderwritingAndy is a seasoned professional in the world of real estate development and lending, bringing decades...

view profile -

Kevin Hill

CFA, Chief Financial OfficerKevin brings over 20 years of expertise in commercial real estate and renewable energy investing,...

view profile -

Ed Carlton

Correspondent LenderEd Carlton, the founder of Bayway Mortgage Group, brings a wealth of experience and expertise to...

view profile -

Anthony Gioia

Lender RelationsAnthony Gioia is a seasoned professional in the field of lender relations and operations, renowned...

view profile

Get started today! Turn liquidity challenges into opportunities with Goldleaf.

Take the next step in scaling your real estate investment business and explore how Goldleaf’s innovative financing solutions can work for you. Contact us today to get started!